The S&P/TSX Venture Composite Index (INDEXTSI:JX) closed at 581.6 last week after seeing peaks and troughs.

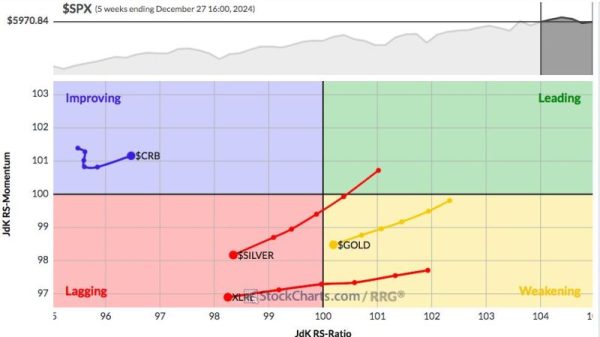

In the resource sector, the gold price saw some momentum, getting back up to the US$1,916 per ounce level after spending time below US$1,900. Its sister metal silver trended up as well, finishing the period at about US$24.22 per ounce.

Against that backdrop, a variety of TSXV-listed resource stocks made moves over the last five days. Read on to find out which companies rose the most during the period and what was affecting their share prices.

1. Founders Metals (TSXV:FDR)

Weekly gain: 85.37 percent; market cap: C$25.67 million; current share price: C$0.75

Founders Metals is focused on its gold projects in South America’s Guiana Shield, particularly its Antino project in Suriname. The company is currently in the middle of its 10,000 meter 2023 exploration program at Antino, which is aimed at expanding high-grade historical gold zones within the Main Antino shear corridor and nearby high-priority targets.

Last Thursday (August 24), Founders released high-grade results from its drilling at the project’s Upper Antino area, with a highlight interval of 30.72 grams per metric ton (g/t) gold over 15.5 meters including 54.61 g/t over 5.8 meters. In addition to the ongoing drilling, the company’s exploration team is performing trenching, channel sampling and auger and soil sampling at targets from its induced polarization survey data.

Founders’ share price soared following the news, moving from C$0.42 on Wednesday (August 23) to a peak of C$0.76 during trading Friday (August 25).

2. Lavras Gold (TSXV:LGC)

Weekly gain: 68.89 percent; market cap: C$14.8 million; current share price: C$0.38

Lavras Gold is focused on its Lavras do Sul gold project in Southern Brazil. Lavras do Sul covers over 22,000 hectares and includes seven advanced mineral deposits and exploration discoveries.

Last Wednesday, Lavras released its Q2 results, in which the company discussed its successful extension of its Zeca Souza discovery as well as two discoveries it made during the quarter, Vila Marieta and Galvao. Lavras said the former is notable for its “significant surface mineralization and long intervals” and the latter is important as it “shows how deep the gold system at Lavras could go” — a drill core at the discovery intersected 10 meters of 4.63 g/t gold at 461 meters vertical depth.

Following the release, Lavras’ share price climbed to reach a peak of C$0.45 last Thursday morning, and although it fell slightly it still ended the week still significantly up.

3. Rome Resources (TSXV:RMR)

Weekly gain: 50 percent; market cap: C$20.86 million; current share price: C$0.27

Rome Resources has an earn-in agreement with Palm Constellation for 51 percent ownership of the Bisie North tin project in the Democratic Republic of Congo. The company recently completed its drilling program at Bisie North and announced results from holes at its Kalayi and Mont Agoma prospects last Wednesday.

Rome highlighted two intervals at Kalayi that it said confirm the significant tin discovery, with one of the two grading 1.06 percent tin over 12.5 meters including 11.7 percent tin over 0.5 meters.

“We consider the initial drilling at Kalayi to be hugely successful as it is unusual to have two intersections of this magnitude from a first round of drilling,” Rome CEO and President Mark Gasson said in the release. As for Mont Agoma, in addition to tin mineralization, results showed significant copper and zinc.

The drill results supported Rome’s share price last week, bringing it to a weekly high of C$0.34 on Wednesday.

4. Decklar Resources (TSXV:DKL)

Weekly gain: 45 percent; market cap: C$13.2 million; current share price: C$0.145

Oil and gas exploration company Decklar Resources is developing the Oza, Asaramatoru and Emohua fields in Nigeria. The company and co-venturer Millennium Oil & Gas Company restarted production of crude oil at Oza in 2022.

Last Friday, Decklar shared an update on its crude oil delivery operations at Oza. After being offline for over a year, the Trans-Niger Pipeline (TNP) that connects to the Bonny export terminal came back online in April. While the connector that serves Oza is not yet operational, the company said it is expected to be in the near future. Decklar also provided updates on its deliveries for purchase agreements with local refineries, which it is fulfilling using other delivery methods.

Once Decklar has access to the TNP, they “anticipate being in a position to maintain continuous production and export activities through the TNP, which is a more cost effective and efficient evacuation system … (than) trucking and selling to local refineries,” Decklar CEO Sanmi Famuyide stated.

After rising earlier in the week last week, the company’s share price jumped to a weekly high of C$0.15 Friday morning.

5. Sterling Metals (TSXV:SAG)

Weekly gain: 43.75 percent; market cap: C$10.13 million; current share price: C$0.115

Sterling Metals is focused on its projects in the province of Newfoundland and Labrador, Canada. The Adeline copper-silver project is located on the continental Labrador and the Sail Pond silver-copper-lead-zinc project is on the island of Newfoundland. The company has a 100 percent earn-in option for both properties.

Although Sterling didn’t release news last week, earlier in August the company shared an update for shareholders that included discussion of its March acquisition of Adeline and its upcoming maiden exploration program at the project as well as its ongoing exploration at Sail Pond. The company’s share price climbed in the second half of the week to peak at C$0.125 early Friday.

FAQs for TSXV stocks

What is the difference between the TSX and TSXV?

The TSX, or Toronto Stock Exchange, is used by senior companies with larger market caps, while the TSXV, or TSX Venture Exchange, is used by smaller-cap companies. Companies listed on the TSXV can graduate to the senior exchange.

How many companies are listed on the TSXV?

As of April 2023, there were 1,713 companies listed on the TSXV, 953 of which were mining companies. Comparatively, the TSX was home to 1,789 companies, with 190 of those being mining companies.

Together the TSX and TSXV host around 40 percent of the world’s public mining companies.

How much does it cost to list on the TSXV?

There are a variety of different fees that companies must pay to list on the TSXV, and according to the exchange, they can vary based on the transaction’s nature and complexity. The listing fee alone will most likely cost between C$10,000 to C$70,000. Accounting and auditing fees could rack up between C$25,000 and C$100,000, while legal fees are expected to be over C$75,000 and an underwriters’ commission may hit up to 12 percent.

The exchange lists a handful of other fees and expenses companies can expect, including but not limited to security commission and transfer agency fees, investor relations costs and director and officer liability insurance.

These are all just for the initial listing, of course. There are ongoing expenses once companies are trading, such as sustaining fees and additional listing fees, plus the costs associated with filing regular reports.

How do you trade on the TSXV?

Investors can trade on the TSXV the way they would trade stocks on any exchange. This means they can use a stock broker or an individual investment account to buy and sell shares of TSXV-listed companies during the exchange’s trading hours.

Data for 5 Top Weekly TSXV Performers articles is retrieved each Friday after market close using TradingView’s stock screener. Only companies with market capitalizations greater than C$10 million prior to the week’s gains are included. Companies within the non-energy minerals and energy minerals are considered.

Securities Disclosure: I, Lauren Kelly, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.