The housing market might be turning around for frustrated would-be buyers as mortgage rates dip and listings rise, according to the real estate brokerage Redfin.

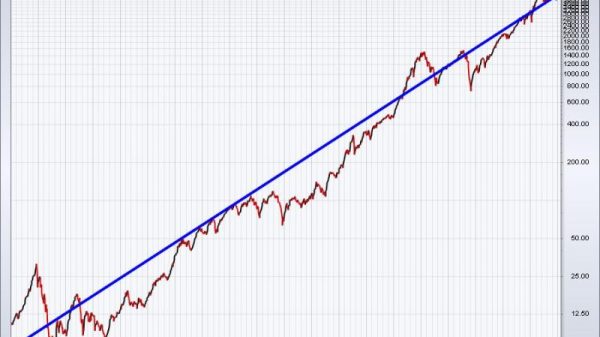

The interest rate on a 30-year fixed mortgage is down to a weekly average of 7.03%, according to government-backed lender Freddie Mac. It peaked at just above 8% in early October. That marked a 23-year high.

In response to that change, Redfin says, mortgage applications are up 15% since early November, when they hit a 28-year low, and new listings of homes are up 7% from last year, when interest rates were spiking.

As a result, applications to buy a home are rising.

But if the housing market is thawing, it’s not happening very quickly. In a news release issued Thursday, Freddie Mac said there are already signs that the growth in applications is slowing down.

‘Although these lower rates remain a welcome relief, it is clear they will have to further drop to more consistently reinvigorate demand,’ it said.

Mortgage rates have decreased recently because investors are becoming convinced that the Federal Reserve is done raising interest rates for now. Between March 2022 and July 2023, the Fed raised its benchmark rate from just over zero to a range of 5.25% to 5.5%. That was a dramatic change, and that made it much more expensive to take out a mortgage.

It also meant people who had owned their homes for at least a few years, who might have locked in a mortgage in the 3% to 4% range, didn’t want to sell. The lack of homes on the market contributed to big increases in home prices.

A month or two of improvement can only go so far in changing that. Redfin said that over the 12 months that ended Dec. 3, the median sale price of a U.S. home rose 4.1% to $364,166. But because of the surge in mortgage rates, the median monthly mortgage payment rose 15%, at $2,561.

That’s a bit better compared to two months ago, but still more than double the average payment from three years ago. The number of homes on the market is still lower than it was at this time last year.

Experts say the only thing that will bring about a sustained change is an increase in the number of homes for sale, and Redfin says that’s starting to happen in some markets. New listings are up, and the decline in older listings is slowing down.

Redfin says that in five of the 50 largest U.S. metro areas, including Portland, Oregon, and Houston, prices are decreasing. It thinks that trend will spread to more cities in 2024 even as mortgage rates slip a bit further.

Overall, the company expects that about 4.3 million homes will be sold in 2024, a 5% increase from 2023, and that mortgage rates will dip to 6.6% by the end of the year.