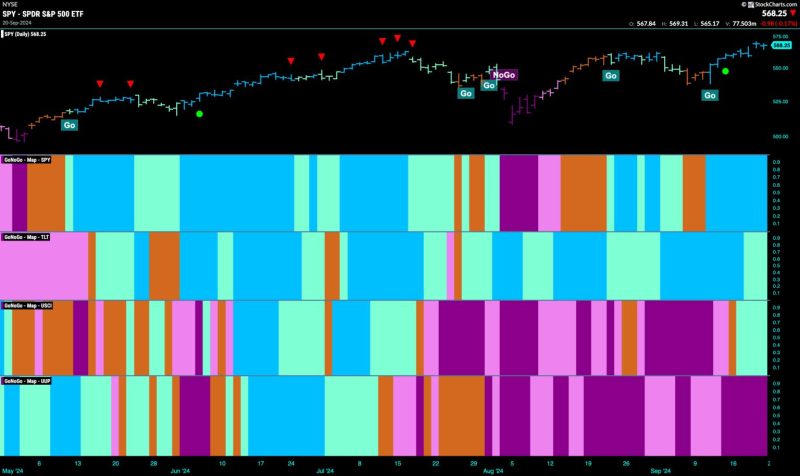

Good morning and welcome to this week’s Flight Path. Equities saw the “Go” trend remain strong with an uninterrupted week of strong blue “Go” bars. Treasury bond prices remained in the “Go” trend as well but we saw weaker aqua bars as the week ended. U.S. commodities returned to a “Go” trend but the indicator painted weaker aqua bars this week. The dollar held on to its strong “NoGo” trend with purple bars.

$SPY Hits New Highs in “Go” Trend

The GoNoGo chart below shows that this week the “Go” trend remained strong as we saw blue bars all week. Price rallied from the last low to set a new higher high which is a good sign for the bulls. GoNoGo Oscillator remained in positive territory and volume increased as we saw it climb further from the zero line. Now, with a “Go” trend in place and momentum in positive territory but not yet overbought, we will look to see if price continues higher.

The longer time frame chart tells us that the “Go” trend is still very much in place. With another strong blue bar and a higher weekly close we can now see the drop in August as a higher low. GoNoGo Oscillator is in positive territory at a value of 3 so not yet overbought. We will look for price to consolidate at these highs and provide a base of support going forward.

“NoGo” Trend Continues on Weaker Pink Bars

Treasury bond yields rose from a new low at the beginning of the week and painted a string of weaker pink “NoGo” bars as price rallied. After setting a new lower low, we will watch to see if price rolls over this week and we see a new lower high. GoNoGo Oscillator is testing the zero level from below and this will be helpful in informing us as to whether the discussed scenario will play out. If the oscillator gets rejected and falls back into negative territory, we will know that momentum is resurgent in the direction of the “NoGo” trend and we will look for trend continuation to the downside.

The Dollar Remains in Strong “NoGo”

Although price has moved mostly sideways this past week staying in a longer trading range, GoNoGo Trend continues to paint strong purple “NoGo” bars. If we look at the GoNoGo Oscillator in the lower panel, we can see that it has struggled to move away from the zero level into positive territory, returning quickly to that level. Now, we see a new GoNoGo Squeeze beginning to build and we will watch to see in which direction it breaks. If it breaks back into negative territory then we will expect trend continuation to the downside.