Interest in lithium continues to grow due to its role in the lithium-ion batteries that power electric vehicles (EVs). As a result, more and more attention is landing on the top lithium-producing countries.

About 80 percent of the lithium produced globally goes toward battery production, but other industries also consume the metal. For example, 7 percent of lithium is used in ceramics and glass, while 4 percent goes to lubricating greases.

According to the US Geological Survey, lithium use in batteries has increased in recent years due to the use of rechargeable batteries in portable electronic devices, as well as in electric tools, EVs and grid storage applications.

Manufacturers commonly use lithium carbonate or lithium hydroxide in these batteries rather than lithium metal. Lithium-ion batteries also include other important battery metals, such as cobalt, graphite and nickel.

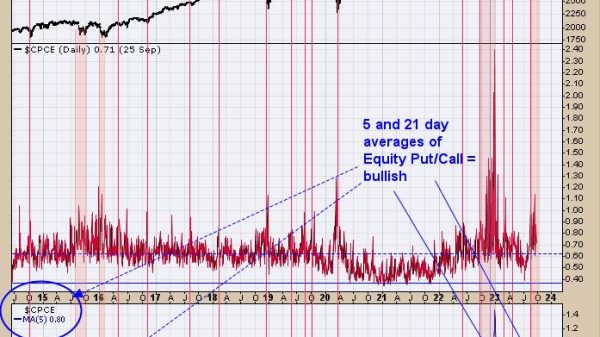

After a volatile 2024 that saw lithium carbonate prices drop 22 percent amid oversupply, analysts predict continued market turbulence in 2025. However, production cuts could narrow the surplus from 84,000 to 33,000 metric tons, while strong EV demand — driven by China’s record sales — remains a key factor, as geopolitical tensions and rising tariffs on Chinese EVs add uncertainty in North America.

Despite the recent market challenges, global lithium demand is set to surge over the next decade due to demand from EVs and energy storage. Benchmark Mineral Intelligence forecasts a more than 30 percent year-on-year increase in demand from these sectors in 2025.

Meeting this growth will require up to 150 new battery factories and US$116 billion in investments by 2030 to prevent supply deficits. China will remain dominant, but the EU and US are poised for the fastest expansion. With lithium mining projected to grow at a 7.2 percent compound annual growth rate through 2035, the sector faces a critical decade of investment and supply chain restructuring.

As demand for lithium continues to rise, which countries will provide the lithium the world requires? The latest data from the US Geological Survey shows that the world’s top lithium-producing countries are doing their best to meet rising demand from energy storage and EVs — in fact, worldwide lithium production rose sharply from 2023 to 2024, coming in at 240,000 metric tons (MT) of lithium content last year, compared to 204,000 MT in 2023. These totals do not include US production, as that data is withheld.

What are the top lithium-producing countries?

Where is lithium mined? Australia, Chile and China are the top three for lithium production by country. Zimbabwe has also risen significantly in the ranks, moving from sixth in 2023 to fourth in 2024. As the EV lithium-ion battery market continues to grow, it’s likely these countries will vie for larger roles in supplying the metal in the years to come.

Read on for our list of top global lithium production by country.

1. Australia

Lithium production: 88,000 metric tons

In 2024, Australia produced 88,000 metric tons of lithium, making it the world’s largest producer of lithium. Although the country tops the list, year-over-year production decreased just over 4 percent from 91,700 MT in 2023 to 88,000 MT in 2024.

It’s likely the country’s lithium production declined in 2024 as a result of weaker demand in the EV space, which in turn pushed lithium prices lower.

Australia is home to many significant lithium mines. The Greenbushes hard rock lithium mine in Western Australia is operated by Talison Lithium, a subsidiary that is jointly owned by miners Albemarle (NYSE:ALB), Tianqi Lithium (OTC Pink:TQLCF,SZSE:002466) and IGO (ASX:IGO,OTC Pink:IPDGF). Greenbushes has been in operation for over a quarter of a century, making it the longest continuously running mining area in the state.

The Greenbushes complex also houses four spodumene concentrate plants with a combined annual production capacity of 1.5 million MT. The mine supplies spodumene to the Kemerton lithium plant and other Albemarle conversion sites worldwide for processing.

Mount Marion, a joint venture between Mineral Resources (ASX:MIN,OTC Pink:MALRF) and Ganfeng Lithium (OTC Pink:GNENF,SZSE:002460,HKEX:1772), is another key lithium mine in Australia. The project, which is located in the Yilgarn Craton, southwest of Kalgoorlie, also contains a processing plant with an annual production capacity of 600,000 MT.

Australia also holds 7 million MT of identified JORC-compliant lithium reserves, which puts it behind Chile’s 9.3 million MT. It is worth noting that most of Australia’s lithium supply is exported to China as spodumene.

2. Chile

Lithium production: 49,000 metric tons

Chilean lithium production topped 49,000 metric tons in 2024. Lithium miners in Chile have steadily increased the nation’s output by 127 percent since 2020 when production was 21,500 MT.

Chile’s year-over-year growth has positioned it as the second top lithium producer in the world. Unlike Australia, where lithium is extracted from hard-rock mines, Chile’s lithium is found in lithium brine deposits.

The Salar de Atacama salt flat in Chile generates roughly half the revenue for SQM (NYSE:SQM), a top lithium producer. The Salar de Atacama is also the home of another top lithium brine producer — US-based Albemarle.

In April 2023, market participants and lithium miners were surprised by the Chilean government’s plans to nationalize the lithium industry. While ultimately it wasn’t a true nationalization, the country is moving to gain controlling stakes in lithium assets in the Salar de Atacama and Maricunga through its state-owned mining company Codelco.

SQM has signed an arrangement with Codelco that will allow it to continue operations in the Salar de Atacama until 2060. The two companies will create a new entity for the operations, with Codelco owning 50 percent plus one share of the company.

Chile’s lithium potential has also attracted the attention of major US oil companies. In February 2025 news broke that Exxon Mobil (NYSE:XOM) is in talks with Chilean officials about lithium opportunities, as fossil fuel firms ramp up investments in EV battery metals.

US oilfield services firm SLB (NYSE:SLB) is also expanding into lithium, with its Head of Mining, Nicholas Lugansky, meeting Chilean officials in January. SLB is among eight companies testing lithium extraction techniques and technologies in northern Chile.

Lithium brine operations in Chile’s Salar de Atacama.

Freedom_wanted / Shutterstock

3. China

Lithium production: 41,000 metric tons

China produced 41,000 metric tons of lithium in 2024, earning it the third spot on the top producing countries list. The Asian country saw its lithium supply grow by nearly 15 percent year-on-year, from 35,700 in 2023 to 41,000 in 2024.

China is the largest consumer of lithium due to its electronics manufacturing and EV industries. It also produces more than two-thirds of the world’s lithium-ion batteries and controls most of the world’s lithium-processing facilities. China currently gets the majority of its lithium from Australia, but it is looking to expand its capacity.

In January of 2024, China announced the discovery of a massive million-metric-ton lithium deposit in the country’s Sichuan Province. Lithium exploration in China over the last three years has boosted the country’s lithium reserves by 1 million MT, to 3 million MT, according to the USGS.

However, in early 2025 the China Geological Survey, pegged the nation’s total reserves to be more than 30 million MT.

4. Zimbabwe

Lithium production: 22,000 metric tons

In 2024 Zimbabwe’s lithium production ballooned to 22,000 metric tons, an exponential increase from 2022’s 800 MT. Year-over-year lithium output rose 47 percent between 2023 and 2024, from 14,900 MT to 22,000 MT.

Total reserves in Zimbabwe have also seen growth climbing from 310,000 MT in 2023 to 480,000 MT as per the US Geological Survey.

In December 2022, Zimbabwe banned the export of raw lithium in an effort to build out the nation’s capacity to process battery-grade lithium domestically. The ban excludes companies that are already developing mines or processing plants in Zimbabwe. Lithium concentrate is now on track to become Zimbabwe’s third biggest mineral export, behind gold and platinum-group metals, reported Reuters in November 2023.

Lithium-producing countries in Africa have attracted much attention from Chinese firms in recent years, especially Zimbabwe. Sinomine Resource Group (SZSE:002738), for example, bought a stake in Zimbabwe’s emerging lithium industry with the purchase of the Bikita mine, the African nation’s oldest lithium mine.

Zimbabwe’s other key lithium mines include Zhejiang Huayou Cobalt’s (SHA:603799) Arcadia mine and state miner Kuvimba Mining House’s Sandawana mine.

In September 2024, Zhejiang Huayou Cobalt and Tsingshan Group,a nickel and stainless steel company, announced plans to study and build a lithium mine and processing plant at Sandawana located in the south of Zimbabwe.

5. Argentina

Lithium production: 18,000 metric tons

Argentina’s annual lithium production grew significantly in 2024, totaling 18,000 metric tons. Year-over-year lithium production increased by more than 100 percent from 8,630 MT in 2023.

It’s well known that Bolivia, Argentina and Chile make up the Lithium Triangle. Argentina’s Salar del Hombre Muerto district hosts significant lithium brines, and its reserves – 4 million MT – are enough for at least 75 years.

At present, lithium mining in the country consists of two major brine operations currently in production and 10 projects that are in development. Analysts at consultancy firm Eurasia Group project that Argentina’s lithium production has the potential to grow approximately tenfold by 2027, as per CNBC.

One of the largest lithium miners in Argentina is Arcadium Lithium (ASX:LTM,NYSE:ALTM), the result of the January 2024 merger of Livent and Allkem. The new entity is the third largest lithium producer in the world. This is soon to change as Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) is set to close its acquisition of Arcadium in early March, bringing its assets under Rio Tinto’s umbrella.

Rio Tinto also owns the Rincon lithium brine project, which is set to be a major contributor to the country’s lithium output once it begins commercial production, targeted for 2028. In December 2024, Rio Tinto announced a US$2.5 billion expansion. Once operational, Rincon will use direct lithium extraction technology and produce 60,000 MT of battery-grade lithium carbonate annually, combining a 3,000 MT starter plant and the 57,000 MT expansion.

6. Brazil

Lithium production: 10,000 metric tons

Lithium production in Brazil continues to trend higher. In 2024 the South American nation produced 10,000 MT, almost double 2023’s 5,260 MT. After achieving output of 400 MT or less from 2011 to 2018, the country’s production hit 2,400 MT in 2019 and has continued to rise year-over-year.

Brazil’s government plans to invest more than US$2.1 billion by 2030 into expanding the nation’s lithium production capacity.

At the state level, in 2023 the Minas Gerais government launched the Lithium Valley Brazil initiative, which is aimed at promoting investment in lithium mining. The program includes four publicly listed lithium companies with assets in the state’s Jequitinhonha Valley: Sigma Lithium (TSXV:SGML,NASDAQ:SGML), Lithium Ionic (TSXV:LTH,OTCQX:LTHCF), Atlas Lithium (NASDAQ:ATLX) and Latin Resources (ASX:LRS,OTC Pink:LRSRF).

EV makers are also eyeing Brazil’s lithium market. In February 2025, Reuters reported that Chinese EV giant BYD (OTC Pink:BYDDF,HKEX:1211,SZSE:002594) reportedly entered the mining sector in 2023, when it acquired 852 hectares of lithium-rich land in Minas Gerais’ Jequitinhonha Valley. The company is currently building an EV factory in Bahia state, but construction was paused at the end of 2024 due to ‘slavery-like’ working conditions.

7. Canada

Lithium production: 4,300 metric tons

Canada’s lithium production increased to 4,300 metric tons in 2024, representing a 32 percent uptick from 2023’s 3,240 MT.

The country currently produces lithium from two operations: the Tanco mine in Manitoba, owned by Sinomine subsidiary Tantalum Mining, and the North American Lithium operation in Québec, a joint venture between Piedmont Lithium (ASX:PLL,NASDAQ:PLL) and Sayona Mining (ASX:SYA,OTCQX:SYAXF).

While Canada is home to a wealth of hard-rock spodumene deposits and lithium brine resources, much of it remains underdeveloped. In an effort to grow a strong North American lithium supply chain for the battery industry, the government has invested in a number of lithium projects, including C$27 million for E3 Lithium (TSXV:ETL,OTCQX:EEMMF), a lithium resource and technology company, and C$1.07 million to private company Prairie Lithium. Both are developing direct lithium extraction technology in Canada’s prairie provinces Alberta and Saskatchewan.

In November 2023, the Canadian government launched the C$1.5 billion Critical Minerals Infrastructure Fund. The fund seeks to address gaps in the infrastructure required for the sustainable development of the nation’s critical minerals production, including battery metals like lithium.

Canada’s efforts were rewarded in early 2024, when BloombergNEF gave the nation the top spot in the fourth edition of its Global Lithium-ion Battery Supply Chain Ranking.

At the end of 2024, the Canadian government’s Export Development Canada program pledged up to C$100 million in financing to Green Technology Metals (ASX:GT1,OTC Pink:GTMLF) for the development of Ontario’s first lithium mine at Seymour Lake.

8. Portugal

Lithium production: 380 metric tons

Portugal’s lithium production remained flat in 2024 coming in at 380 metric tons, the same tally as the previous year. Output has declined drastically since 2021, when its lithium production reached 900 MT.

Most of Portugal’s lithium comes from small-scale operations targeting quartz and feldspar. Despite this lithium-producing country’s comparatively low output, Portugal’s lithium reserves stand at 60,000 MT.

In September 2024, Savannah Resources (LSE:SAV,OTC Pink:SAVNF) delayed the start of lithium production at its Barroso project in Portugal to 2027, citing prolonged environmental approval processes and regulatory hurdles. The project has also received public backlash due to concerns about the environmental impact of lithium mining.

The project, set to be Western Europe’s first significant lithium mine, is projected to play a pivotal role in the EU’s ambitions of battery material self-sufficiency. Despite the setback, Savannah remains committed to advancing the development, emphasizing its role in strengthening Europe’s EV supply chain.

9. United States

Lithium production: Withheld

In the final place on this top lithium-producing countries list is the US, which has withheld production numbers to avoid disclosing proprietary company data. Its only output last year came from two operations: a Nevada-based brine operation, most likely in the Clayton Valley, which hosts Albemarle’s Silver Peak mine, and the brine-sourced waste tailings of Utah-based US Magnesium, the largest primary magnesium producer in North America.

There are a handful of major lithium projects underway in the US, including Lithium Americas’ (TSX:LAC,NYSE:LAC) Thacker Pass lithium claystone project, Piedmont Lithium’s hard-rock lithium project and Standard Lithium’s (TSXV:SLI,OTCQX:STLHF) Arkansas Smackover lithium brine project.

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.