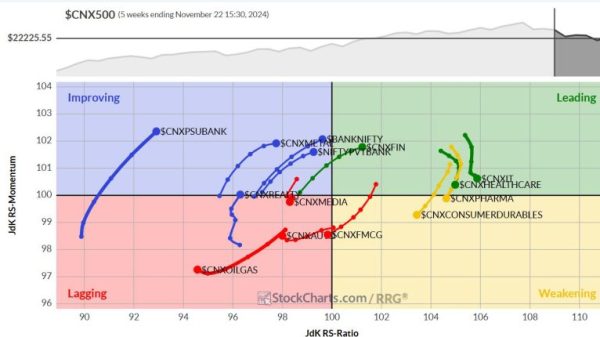

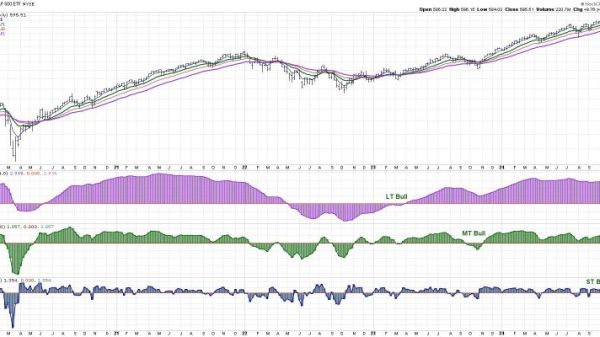

The market rally last week was very narrow, driven mainly by large gains in communication services stocks like Meta. Many technical indicators are showing negative divergences. The broader market struggled. Erin reviews all of the sectors under the hood and then takes your symbol requests.

Key Takeaways:

– Communication services and technology sectors look strongest, while materials, energy, and real estate look weakest. Industrials were identified as a sector to watch this week.

– Treasury yields bounced last week but the yield curve remains inverted, which can be a sign of economic weakness.

– Specific stocks discussed included PHR (buy opportunity on pullback), LDS (lined up technically but wait for better entry), and CRWD (hold with tight stop).

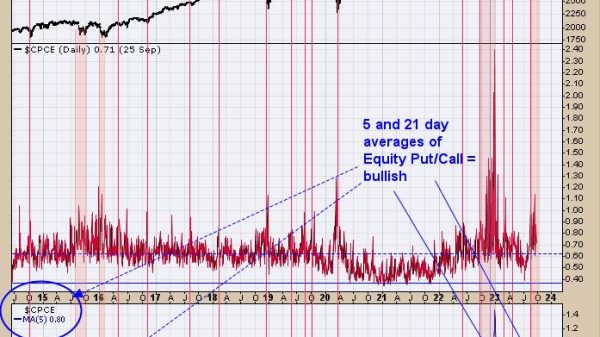

– The presenters have a bearish short-term outlook on the market and expect prices to move lower this week. Defensive sectors may outperform if the market declines.

Watch the latest episode of the DecisionPoint Trading Room on our YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)